-

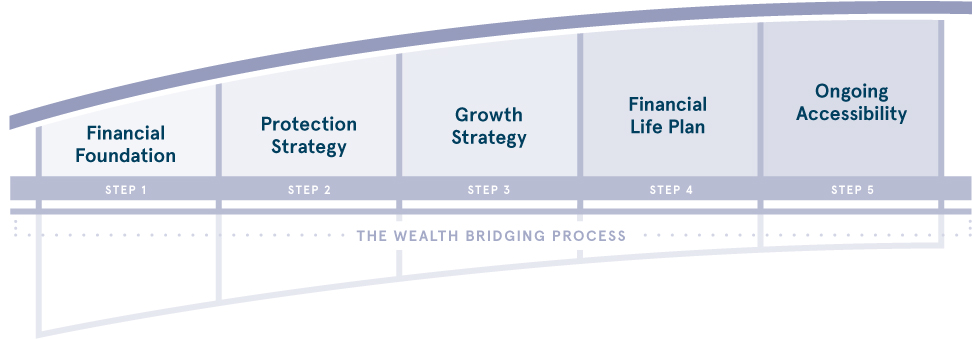

STEP 1: Financial Foundation

First, we work to uncover a clear picture of your current and future needs. More than just a basic needs assessment, we dive deep into what’s most important to you, what kind of lifestyle you envision for retirement and financial considerations ranging from insurance to taxes.

-

STEP 2: Protection Strategy

The first major component of your financial life plan is protection. Our focus during this stage is to identify any liabilities or gaps within your current situation, while building the strategies that will help mitigate risk moving forward.

-

STEP 3: Growth Strategy

With a solid protection strategy in place, we can balance the preservation you’ll need for retirement with the growth and cash flow objectives that are integral to maintaining your lifestyle over time. We customize your investment portfolio and design efficient growth and income strategies that align with your lifestyle goals.

-

STEP 4: Financial Life Plan

In addition to your protection and growth strategies, we incorporate key financial steps to round out your financial life plan. This often involves recourse to our network of professionals, including accountants, lawyers and financial specialists. We meet with you to walk you through the solutions we’ve designed, and ensure you have a clear understanding of how your lifestyle and retirement goals will be supported by your financial life plan.

-

STEP 5: Ongoing Accessibility

The effectiveness of your financial life plan hinges on how well it’s implemented and maintained. We take an active approach to monitoring and updating your plan so that it stays relevant to your needs. With regular communication from our friendly team and accessibility standards to ensure to stay informed, we also serve as your ongoing, confidential contact for all financial matters.